Filing an Income Tax Return (ITR) is a legal obligation for salaried individuals in India whose income exceeds the basic exemption limit. It ensures transparency in financial dealings and allows individuals to claim refunds, if any. With advancements in digital infrastructure, the process has become more streamlined, enabling taxpayers to file returns online with ease.

Step-by-Step Guide to Filing ITR Online for Salaried Employees

1. Determine the Applicable ITR Form

For most salaried individuals with income up to ₹50 lakh from salary, one house property, and other sources like interest income, ITR-1 (Sahaj) is applicable. If you have capital gains, foreign income, or income from more than one house property, ITR-2 may be appropriate.

2. Gather Necessary Documents

Ensure you have the following documents:

- Form 16: Provided by your employer, detailing salary and TDS.

- Form 26AS: A consolidated tax statement available on the Income Tax portal.

- Salary Slips: For income verification.

- Investment Proofs: For deductions under sections like 80C, 80D, etc.

- Bank Statements: To report interest income.

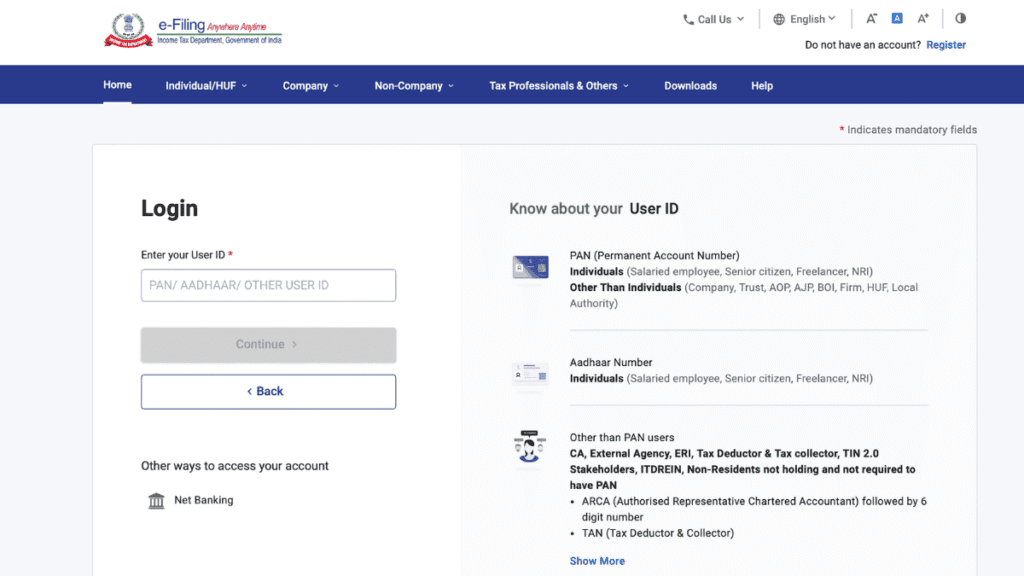

3. Register/Login on the Income Tax E-Filing Portal

- Visit https://www.incometax.gov.in.

- Register using your PAN, which serves as your user ID.

- If already registered, log in using your credentials.

4. Link PAN with Aadhaar

Ensure your PAN is linked with Aadhaar to avoid issues during filing. As per current regulations, linking PAN with Aadhaar is mandatory.

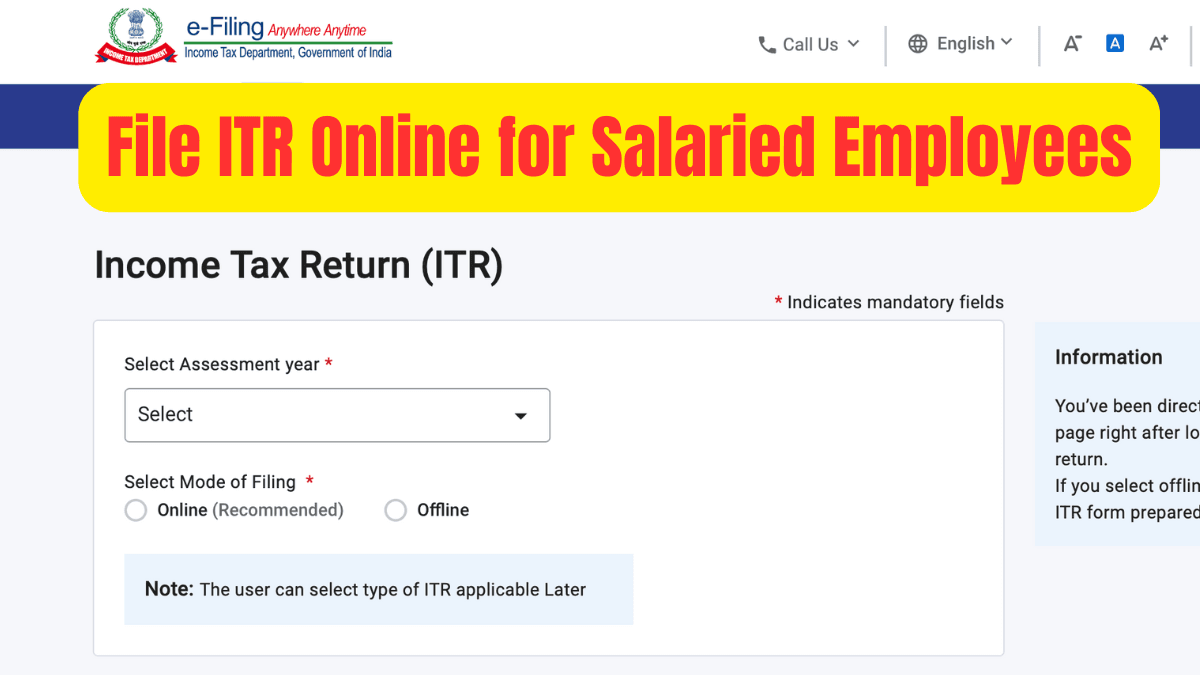

5. Choose the Appropriate ITR Form

- After logging in, navigate to ‘e-File’ > ‘Income Tax Return’.

- Select the assessment year (2025–26) and the applicable ITR form (e.g., ITR-1).

Key Changes in ITR Forms for AY 2025–26

ITR-1: Now accommodates reporting of long-term capital gains up to ₹1.25 lakh.

ITR-2: Introduced separate sections for capital gains and increased reporting thresholds for assets and liabilities.

Also Read: Filing ITR in 2025? Old vs. New Tax Regime: Don’t File Your ITR Without Reading This

6. Fill in the Details

- Personal Information: Verify pre-filled details like name, PAN, Aadhaar, address, etc.

- Income Details: Enter salary details as per Form 16.

- Deductions: Claim deductions under relevant sections.

- Tax Paid: Verify TDS details from Form 26AS.

7. Validate and Submit

- After filling in all details, validate each section.

- Once validated, proceed to submit the return.

8. E-Verification

Post submission, verify your return electronically using:

- Aadhaar OTP

- Net banking

- Bank account EVC

- Demat account EVC

E-verification is mandatory to complete the filing process.

Also Read: Home Loan Tax Benefits FY 2025-26: Save Up to ₹3.5 Lakh With These Deductions

July 31, 2025 is last date to file ITR for individuals not requiring audit.

December 31, 2025 is last date to file belated or revised return.

FAQs

Q1. Can I file ITR without Form 16?

Yes, you can file ITR without Form 16 by referring to your salary slips, bank statements, and Form 26AS to compute your income and TDS details.

Q2. What happens if I miss the ITR filing deadline?

If you miss the deadline, you can file a belated return by December 31, 2025, with applicable late filing fees and interest.

Q3. Is it mandatory to e-verify the ITR?

Yes, e-verification is mandatory to complete the ITR filing process. Without e-verification, your return will not be processed.

Q4. Can I revise my ITR after filing if I make a mistake?

Yes, if you discover any mistake after filing your ITR (like incorrect income details or missing deductions), you can file a revised return under Section 139(5) before December 31, 2025. Just log in to the Income Tax portal, choose the “Revised Return” option, and correct the errors without penalties if it’s within the due time.

Q5. What should I do if Form 16 details don’t match with Form 26AS?

If there’s a mismatch between Form 16 and Form 26AS, first check with your employer for possible errors in TDS reporting. Ensure that the TDS is correctly reflected in Form 26AS before filing your ITR. Always file based on Form 26AS, as it’s the official record with the Income Tax Department.

Comments are closed.