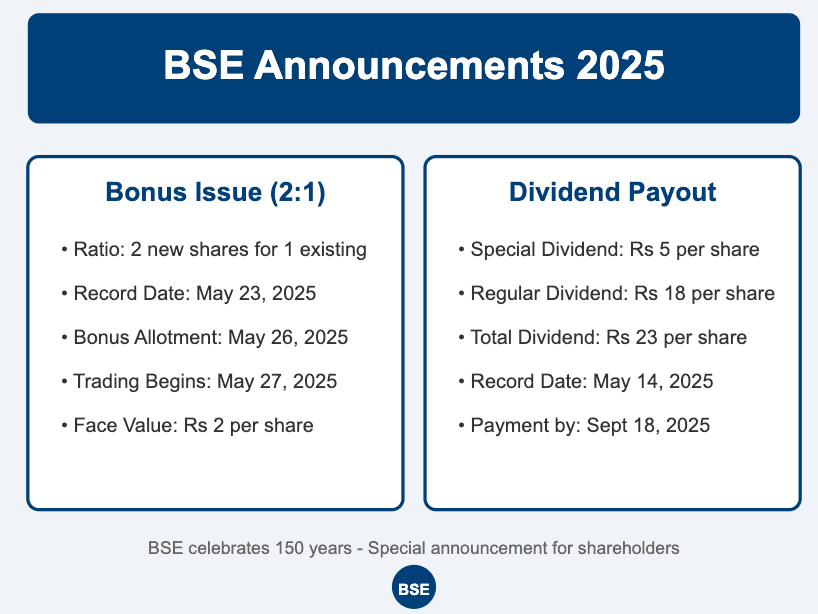

On May 23, 2025, BSE Ltd. shares experienced a significant decline of approximately 66.6% during the trading session.This sharp drop coincided with the stock trading ex-bonus, following the implementation of a 2:1 bonus share issue. In this bonus issue, shareholders received two additional shares for every one share held, effectively tripling the number of outstanding shares.

The apparent steep decline in BSE’s share price is a technical adjustment reflecting the increased number of shares in circulation. When a company issues bonus shares, the share price adjusts proportionally to maintain the overall market capitalization. For instance, if a stock priced at ₹6,996 undergoes a 2:1 bonus issue, the price would adjust to approximately ₹2,335 post-issue.

This adjustment does not indicate a loss in the company’s value or a deterioration in its financial health. The total investment value for shareholders remains unchanged, as the decrease in share price is offset by the increase in the number of shares held.

Market Reaction and Investor Sentiment

Despite the technical nature of the price adjustment, such significant percentage drops can cause confusion among investors, particularly those unfamiliar with corporate actions like bonus issues. It’s essential for investors to understand that the intrinsic value of their holdings remains the same post-adjustment.

Financial experts emphasize that such price movements are standard following bonus issues and should not be misconstrued as negative market sentiment or a reflection of the company’s performance.

BSE’s Financial Health and Future Outlook

BSE Ltd. continues to demonstrate robust financial health, with consistent performance and strategic initiatives aimed at enhancing shareholder value. The bonus issue is part of the company’s ongoing efforts to reward shareholders and improve stock liquidity.

Investors are advised to stay informed about corporate actions and understand their implications to make well-informed investment decisions. Consulting with financial advisors can provide additional clarity and guidance tailored to individual investment goals.

Disclaimer:

The views and investment tips expressed by investment experts, brokers, or agencies on Equitywatch.in are their own and not that of the website or its management. Investing in equities poses a risk of financial losses. Investors must exercise caution while making investment decisions. Neither Equitywatch nor the author is liable for any losses arising from decisions based on this article. Please consult your registered investment advisor before investing.