The Udyam Registration process, introduced by the Ministry of MSME in 2020, is entirely online, paperless, and free of cost. This guide will walk you through the steps to obtain your Udyam Registration online in 2025.

What is Udyam Registration?

Udyam Registration is the Government of India’s digital certification system for Micro, Small, and Medium Enterprises. This paperless, fee-free process provides a unique identification number and certificate based on self-declaration, enabling access to prioritized policy benefits under the MSMED Act. Registration remains mandatory for availing central and state-level enterprise incentives.

Advantages of Udyam Registration

- Financial Access: Eligibility for CGTMSE collateral-free loans and interest subsidies

- Regulatory Simplification: Expedited industry licensing and environmental clearances

- Payment Security: Legal recourse against buyer payment delays exceeding 45 days

- Operational Cost Reduction: Electricity tariff concessions (state-specific)

- Quality Certification Support: Reimbursement for ISO certification expenses

Steps to Free Udyam Registration online

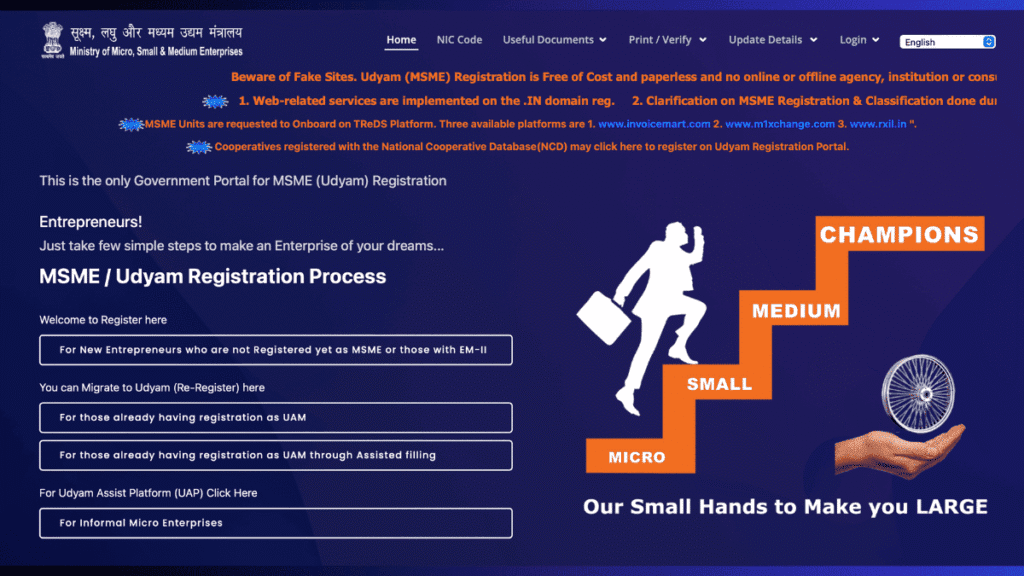

- Portal Access

Navigate to the official Udyam portal: udyamregistration.gov.in

- Initial Registration Selection

Click “For New Entrepreneurs” - Aadhaar Authentication

Enter 12-digit Aadhaar → Validate via mobile OTP - Enterprise Data Entry

Input:- Business name and organizational type (Proprietorship/LLP/Company)

- Complete operational address

- NIC code aligned with economic activity

- Bank account details

- Tax Identifier Submission

Provide PAN and GSTIN (if applicable) - Final Submission

Review declarations → Submit application - Certificate Generation

Receive Udyam Registration Number (URN) and e-certificate instantly

Also Read: Filing ITR in 2025? Old vs. New Tax Regime: Don’t File Your ITR Without Reading This

Essential Documents Required MSME Udyam Registration

- Primary: Proprietor/partner/director Aadhaar

- Enterprise: PAN, GSTIN (where mandatory)

- Operational: Business address and NIC code

- Financial: Active bank account details

Note:-

Zero Registration Fees: Beware of third-party scams

Aadhaar-Linked Restriction: One enterprise per Aadhaar holder

Data Accuracy: Mismatches in PAN/GST/Aadhaar cause rejection

Disclaimer: The information provided in this article is for general informational purposes only. While we strive to keep the information up to date and correct, we make no representations or warranties of any kind. For official guidelines and registration, please visit udyamregistration.gov.in.